Planning for a comfortable retirement

Posted by siteadmin on Monday 9th of May 2022

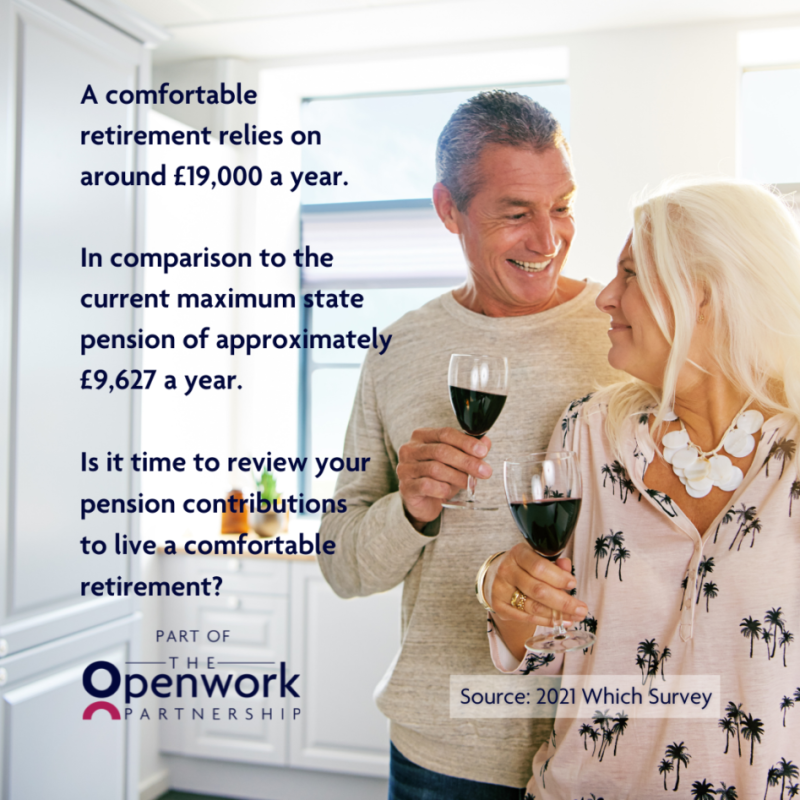

Tina is a fit and vibrant 59-year-old who expected retirement to offer a whole new lease of life. She was looking forward to using her increased leisure time to explore Europe while indulging her passion for climbing. However, after going through her finances, she’s now concerned she won’t be able to afford her monthly bills let alone pay for trips abroad.

Tina has always managed her day-to-day finances really well, but she never sat down and worked out how much she’d need for a comfortable retirement. A 2021 Which survey found that a retir...

Get Savvy Against Scammers

Posted by siteadmin on Wednesday 27th of April 2022

Retired teachers Paul and Mary are devoted parents and grandparents to their three children and eight grandchildren. As their family started to grow, they decided they wanted to begin saving for their grandchildren’s future. Disappointed with the returns from their savings accounts, they decided to look into other investment opportunities. After comparing a number companies online, they settled on one and made a £30,000 bank transfer. Within just a few months, their initial investment had grown sizably.

Soon afterwards, their eldest grand...

World Earth Day 2022 - Climate Change Showcase

Posted by siteadmin on Friday 22nd of April 2022

Volatility and Long-term investors

Posted by siteadmin on Wednesday 30th of March 2022

As the conflict in Ukraine escalates and Russia continues its invasion of Ukraine major stock markets have fallen dramatically. But what does this mean for your investments?

Stories about stock market falls are guaranteed to make headlines like the financial crisis of 2008 and the stock market lows of March 2009. And for many they are still fresh memories but it’s worth noting that an investment then in global stocks would have grown more than twofold a decade down the line*.

That might be an extreme example with those kinds of returns nev...

Staying Calm in Turbulent Times - Video Update

Posted by siteadmin on Monday 21st of March 2022

Rohit Vaswani, Client Portfolio Manager shares views on some of investors' concerns given the recent market volatility. Whilst markets are more volatile at the moment, we have seen episodes like these before and we look at back at history to understand what this means for those who are investing for the longer term.

We hope you find this video helpful, and if you do have any questions, please speak to your financial adviser.

Getting Mortgage Ready

Posted by siteadmin on Monday 14th of March 2022

Whether you’re a first-time buyer, a second-stepper or further up the housing ladder, buying a home is always a big move and can feel a bit like a roller coaster ride at the best of times. With 60% of buyers reporting being put off moving because they find the idea overwhelming, here are some tips that can help you navigate the process as smoothly as possible.

Save up

You will need to have saved a deposit - in most cases the bigger the deposit you can put down, the lower your interest rate is likely...

Are you making the most of your ISA allowance?

Posted by siteadmin on Monday 7th of March 2022

In the Financial Lives 2020 survey from the FCA, it has been found that older adults were more likely to hold a savings account of any type, than younger adults. For example, 83% of those aged 55+ did, compared with 63% of 18–24-year-olds. So, how could an ISA help you?

ISA

An ISA is an individual savings account that allows you to save tax-free money in a cash or investment account, so you could end up getting more for your money. An ISA is a medium to long term investment, which aims to increase the value of the money you invest for growth...

Investment update - A Volatile Period for Markets

Posted by siteadmin on Wednesday 2nd of March 2022

High inflation, disappointing earnings results from some tech companies and Russia’s invasion in Ukraine caused turbulence for the financial markets.

The reality of armed conflict between Russia and Ukraine pushed down leading stock market indices during February. Since the start of the year, conditions have been volatile owing to concerns about persistently high inflation and central bank interest rate rises. Geopolitical tensions added further uncertainty, with rapidly changing events causing markets to slide around the world.

Oil pric...

Junior ISA

Posted by siteadmin on Friday 25th of February 2022

In the Autumn Budget in 2021, it was revealed that the Junior ISA spending limits would remain at £9,000 for the 2022/2023 tax year. The JISA limit was last changed in early 2020, when it was doubled from £4,500 to its current level.

JISA and CTFs both benefit

JISAs replaced Child Trust Funds (CTF) in 2011, but those who still hold CTF will continue to benefit from the increased allowance. Both JISA and CTF are a tax efficient way to build up savings for a child. It is not possible to have both a JISA and a CTF.

Savings for children

A junior...

Reckless Caution Is Costing Savers

Posted by siteadmin on Friday 11th of February 2022

New research from The Openwork Partnership, one of the UK’s largest and longest established financial advice and investment networks, shows more than 11.6 million are keeping all their money in cash despite ongoing low rates.

New research from The Openwork Partnership, one of the UK’s largest and longest established financial advice and investment networks, shows more than 11.6 million are keeping all their money in cash despite ongoing low rates.

Its nationwide study found 22% of adults prefer to keep all their money in cash while the same number will not consider stock market investments despite potentially higher returns as they don’t understand it.

The Openwork Partnership is warning about the risks to savers of reckless caution – the cost of missing out on...